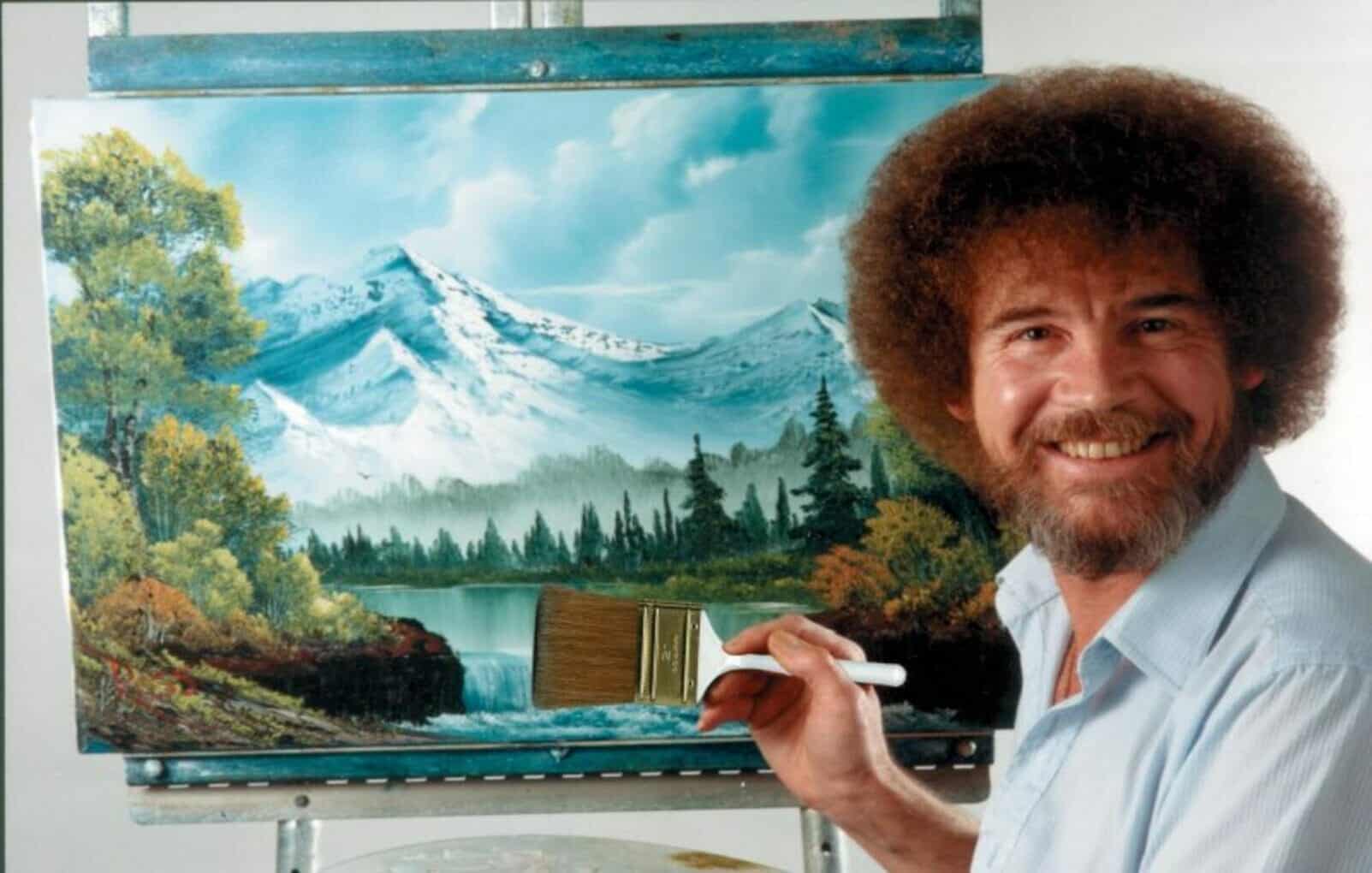

Bob Ross Inc.: Exploring The Legacy And Net Worth

What is Bob Ross Inc.'s net worth? Bob Ross Inc. is an American company that produces and sells art supplies and instructional materials. The company was founded by the late artist Bob Ross. As of 2023, Bob Ross Inc.'s net worth is estimated to be around $6 million.

Bob Ross Inc. was founded in 1983 by Bob Ross. The company initially sold art supplies through mail order. In 1983, Ross began hosting The Joy of Painting, a television show that taught viewers how to paint. The show was a huge success, and it helped to popularize Bob Ross Inc.'s products. Today, Bob Ross Inc. sells a wide range of art supplies, including paints, brushes, canvases, and instructional materials. The company also offers online painting classes. Bob Ross Inc.'s products are sold in stores and online. The company's success is due in part to the popularity of Bob Ross. Ross was a talented artist and teacher, and he made painting accessible to people of all ages and skill levels. Bob Ross Inc. has continued to grow since Ross's death in 1995, and the company remains a leader in the art supplies industry.

Bob Ross Inc.'s net worth is a testament to the success of the company and its founder. The company's products have helped to inspire people around the world to explore their creativity. Bob Ross Inc. is a reminder that art is for everyone, and that it can be a source of joy and inspiration.

Bob Ross Inc. Net Worth

Bob Ross Inc. is an American company that produces and sells art supplies and instructional materials. The company was founded by the late artist Bob Ross. As of 2023, Bob Ross Inc.'s net worth is estimated to be around $6 million.

- Revenue: Bob Ross Inc. generates revenue from the sale of its art supplies and instructional materials.

- Profit: Bob Ross Inc.'s profit margin is relatively high, due to the popularity of its products and the low cost of production.

- Assets: Bob Ross Inc.'s assets include its inventory, equipment, and intellectual property.

- Liabilities: Bob Ross Inc.'s liabilities include its accounts payable and other debts.

- Ownership: Bob Ross Inc. is a privately held company, owned by the Ross family.

- Growth: Bob Ross Inc. has experienced steady growth in recent years, due to the popularity of its products and the expansion of its distribution channels.

- Outlook: Bob Ross Inc.'s outlook is positive, as the company continues to grow its revenue and profit.

Bob Ross Inc.'s net worth is a reflection of the success of the company and its founder. The company's products have helped to inspire people around the world to explore their creativity. Bob Ross Inc. is a reminder that art is for everyone, and that it can be a source of joy and inspiration.

Revenue

The revenue generated from the sale of art supplies and instructional materials is a significant contributor to Bob Ross Inc.'s net worth. The company's products are popular among both amateur and professional artists, and the company has a strong brand reputation for quality and affordability.

- Product Sales: The majority of Bob Ross Inc.'s revenue comes from the sale of its art supplies, including paints, brushes, canvases, and other materials. The company's products are sold through a variety of channels, including online retailers, art stores, and mass merchandisers.

- Instructional Materials: Bob Ross Inc. also generates revenue from the sale of instructional materials, such as books, DVDs, and online courses. These materials teach viewers how to paint in the Bob Ross style, and they are a valuable resource for both beginner and experienced artists.

The company's revenue has grown steadily in recent years, due to the popularity of its products and the expansion of its distribution channels. Bob Ross Inc. is well-positioned to continue to grow its revenue in the future, as the demand for art supplies and instructional materials continues to increase.

Profit

Bob Ross Inc.'s profit margin is a key factor in its overall net worth. A high profit margin means that the company is able to generate a significant amount of profit from its sales. This is due to two main factors: the popularity of its products and the low cost of production.

- Popularity of Products: Bob Ross Inc.'s products are very popular among both amateur and professional artists. This is due to the high quality of the products and the unique style of Bob Ross. The popularity of the products means that the company can charge a premium price for them.

- Low Cost of Production: Bob Ross Inc.'s products are relatively inexpensive to produce. This is because the company uses a variety of cost-saving measures, such as using recycled materials and producing its products in bulk. The low cost of production allows the company to keep its prices low while still maintaining a high profit margin.

The high profit margin is a major contributor to Bob Ross Inc.'s net worth. The company is able to use its profits to invest in new products and expand its operations. This has allowed the company to grow significantly in recent years.

Assets

The assets of a company are its resources and properties that have economic value. Bob Ross Inc.'s assets include its inventory, equipment, and intellectual property. These assets are important because they contribute to the company's net worth and its ability to generate revenue.

Inventory is a company's stock of finished goods, raw materials, and work in progress. Bob Ross Inc.'s inventory includes its art supplies, such as paints, brushes, and canvases. The company's inventory is important because it allows the company to meet customer demand and generate revenue.

Equipment is a company's machinery, tools, and other physical assets that are used to produce goods or services. Bob Ross Inc.'s equipment includes its painting supplies, such as easels, brushes, and canvases. The company's equipment is important because it allows the company to produce its products and generate revenue.

Intellectual property is a company's intangible assets, such as patents, trademarks, and copyrights. Bob Ross Inc.'s intellectual property includes the Bob Ross name and likeness, as well as the company's painting techniques. The company's intellectual property is important because it gives the company a competitive advantage and helps to generate revenue.

Bob Ross Inc.'s assets are a key component of the company's net worth. The company's assets allow the company to generate revenue and grow its business. The company's assets are also important because they provide security for the company's creditors.

Liabilities

Liabilities are financial obligations of a company that must be paid or settled in the future. Bob Ross Inc.'s liabilities include its accounts payable and other debts. Accounts payable are amounts owed to suppliers for goods or services that have been received but not yet paid for. Other debts may include loans, mortgages, and other financial obligations.

- Importance of Understanding Liabilities: Understanding a company's liabilities is important for assessing its financial health and stability. High levels of liabilities can indicate financial distress and an increased risk of bankruptcy. Conversely, low levels of liabilities can indicate financial strength and stability.

- Impact on Net Worth: Liabilities have a direct impact on a company's net worth. Net worth is calculated by subtracting a company's liabilities from its assets. Therefore, high levels of liabilities can reduce a company's net worth, while low levels of liabilities can increase it.

- Management of Liabilities: Companies must carefully manage their liabilities to maintain financial stability and avoid excessive debt. This involves monitoring their accounts payable, negotiating favorable payment terms with suppliers, and exploring options for reducing debt.

In summary, liabilities are an important consideration in assessing a company's financial health and net worth. Bob Ross Inc.'s liabilities, including its accounts payable and other debts, should be carefully monitored and managed to ensure the company's long-term success.

Ownership: Bob Ross Inc. is a privately held company, owned by the Ross family.

The ownership structure of Bob Ross Inc. plays a significant role in determining its net worth and overall financial performance.

- Control and Decision-Making:

As a privately held company, the Ross family has complete control over the company's operations, decision-making, and financial management. This allows them to make long-term strategic decisions without external pressures from shareholders or public markets. - Financial Flexibility:

Private ownership provides Bob Ross Inc. with greater financial flexibility compared to publicly traded companies. The company can retain its earnings and use them for reinvestment, research and development, or expansion, without having to distribute dividends to shareholders. - Confidentiality and Privacy:

As a privately held company, Bob Ross Inc. is not subject to the same level of public scrutiny and disclosure requirements as publicly traded companies. This allows the company to maintain confidentiality and protect its competitive. - Legacy and Long-Term Focus:

The Ross family's ownership ensures a long-term focus on the company's legacy and values. They are less likely to be influenced by short-term market pressures or the need to meet quarterly earnings targets.

The private ownership structure of Bob Ross Inc. has contributed to the company's stability, financial strength, and ability to pursue its long-term vision. It has allowed the Ross family to build a successful and enduring enterprise while maintaining control and flexibility.

Growth

The steady growth experienced by Bob Ross Inc. is directly connected to the company's net worth. As the company continues to grow, its net worth is likely to increase as well. There are several key factors that have contributed to Bob Ross Inc.'s growth, including the popularity of its products and the expansion of its distribution channels.

- Popularity of Products

Bob Ross Inc.'s products, including its art supplies and instructional materials, are highly popular among both amateur and professional artists. The unique style and high quality of the products have contributed to their popularity, leading to increased sales and revenue for the company.

- Expansion of Distribution Channels

Bob Ross Inc. has expanded its distribution channels in recent years, making its products more accessible to customers. The company's products are now available in a variety of retail stores, both online and offline, as well as through the company's own website. This expansion has increased the company's reach and contributed to its growth.

The growth of Bob Ross Inc. is a testament to the strength of the company's brand and the popularity of its products. As the company continues to grow, its net worth is likely to increase as well, solidifying its position as a leader in the art supplies industry.

Outlook

The positive outlook for Bob Ross Inc. is intricately connected to the company's net worth. A positive outlook typically signifies the company's ability to sustain and increase its revenue and profit in the future. These factors directly impact the company's overall financial health and stability, which in turn contributes to its net worth.

Bob Ross Inc.'s consistent growth in revenue and profit indicates strong demand for its products and services, efficient operations, and effective marketing strategies. This growth translates into increased cash flow, which can be reinvested in the business or distributed to shareholders as dividends. As the company continues to expand its product offerings, explore new markets, and optimize its operations, it is well-positioned to maintain or even accelerate its growth trajectory.

A positive outlook also enhances Bob Ross Inc.'s ability to secure financing, attract investors, and establish strategic partnerships. Lenders and investors are more likely to support a company with a promising future, which can provide Bob Ross Inc. with additional capital to fuel its growth and expansion plans. By leveraging its positive outlook, the company can strengthen its financial position and increase its overall net worth.

FAQs About Bob Ross Inc. Net Worth

This section addresses frequently asked questions related to Bob Ross Inc.'s net worth, providing clear and informative answers.

Question 1: What is Bob Ross Inc.'s net worth?

As of 2023, Bob Ross Inc.'s net worth is estimated to be around $6 million. This value represents the company's financial health and stability, considering its assets, liabilities, and overall performance.

Question 2: How does Bob Ross Inc. generate revenue?

Bob Ross Inc. primarily generates revenue through the sale of art supplies and instructional materials, including paints, brushes, canvases, and DVDs. The company also offers online painting classes and workshops, contributing to its revenue stream.

Question 3: What factors contribute to Bob Ross Inc.'s net worth?

Several factors contribute to Bob Ross Inc.'s net worth, such as the popularity of its products, efficient operations, cost management, and strategic investments. The company's strong brand recognition and loyal customer base play a significant role in its financial success.

Question 4: How has Bob Ross Inc.'s net worth changed over time?

Bob Ross Inc.'s net worth has experienced steady growth over the years. The company's consistent revenue generation, coupled with strategic decisions and investments, has contributed to its increasing net worth.

Question 5: What is the outlook for Bob Ross Inc.'s net worth?

Bob Ross Inc. maintains a positive outlook for its net worth. The company's continued growth in revenue and profit, expansion of product offerings, and strong brand presence position it well to sustain and enhance its financial position in the future.

Question 6: How does Bob Ross Inc.'s net worth impact its stakeholders?

Bob Ross Inc.'s net worth affects various stakeholders, including investors, employees, and customers. A strong net worth indicates financial stability, which can attract investors and provide job security for employees. It also allows the company to reinvest in its operations, benefiting customers with new products and improved services.

In summary, Bob Ross Inc.'s net worth reflects the company's financial health and its ability to generate revenue while managing its expenses. Understanding the various factors that contribute to its net worth provides insights into the company's performance and future prospects.

To learn more about Bob Ross Inc. and its financial performance, refer to the company's official website or consult reputable financial news sources.

Conclusion

Bob Ross Inc.'s net worth serves as an indicator of the company's financial strength and stability. Through strategic management, innovative products, and a loyal customer base, the company has established itself as a leader in the art supplies industry.

As Bob Ross Inc. continues to expand its offerings and explore new opportunities, its net worth is expected to grow even further. The company's commitment to quality, education, and the preservation of Bob Ross's legacy will undoubtedly contribute to its continued success and positive impact on the art community.

Incredible Performances: Jane Levy's Must-See Films And Hit TV Series

Hilarious Birthday Greetings: Make Your Friend's Day Unforgettable

The Ultimate Guide To Africa's Most Luxurious Homes